verdict : yes, and we should continue supporting small businesses

- Revised from “no” on 2020-10-23

On the face of it Prop 15 seems like a no-brainer, if you believe taxes should be proportional to wealth and value. It undoes 1978’s Prop 13 for commercial property, resetting property taxes to market rates for rich commercial real estate owners. This money goes straight to underfunded public schools, community colleges, and local governments.

Our educational system needs help, and the perfect storm of (a) local school funding, (b) fixed in time property taxes, and (c) skyrocketing housing costs, are creating unacceptable conditions for our educators and our students. Everybody suffers when education suffers. We must ensure that free, quality education is available to everybody.

It’s also clear that large property owners are receiving unreasonable “Prop 13” tax protection. They are shielded from the tax consequences of appreciating land value, while being able to charge increased rents because of that same appreciating value. This is double-dipping into the public wealth.

Of course not all commercial owners are wealthy. Prop 15 excludes businesses owning less than three million dollars in total commercial property. It also waives half a million dollars of business equipment from taxes, and exempts small businesses altogether.

Commercial tenants could see rents go up, via passed-through property tax increases. The equipment tax write-off might or might not make this up. According to the Attorney General, “property taxes on business equipment probably would be several hundred million dollars lower each year”.

So what is it? What’s the actual impact? I am sympathetic to Prop 15 opponents saying small businesses will suffer. I originally came out against Prop 15 but my friends Peter Rodrigues (a Berkeley teacher!), Roman Kofman, Rachel Coen, and my father Charles Haley talked about it with me – and convinced me that ultimately Prop 13 is more foundationally harmful and that Prop 15 impacts are fixable.

I’d already analyzed the land tax implications; I now factor in business equipment as well. This hypothetical business ends up losing $2,800 per year due to Prop 15. 😓

According to the California Government, as of September 2020, 44% of small businesses were at risk of shutting down due to the COVID-19 pandemic. This represents 48.5% of the state’s total workforce. Now is not the time to squeeze them further, directly or indirectly. But Prop 15 has a phased implementation, and with any luck we’ll be out of the pandemic by the time it takes full effect.

Either way the State Legislature can monitor the impact, and in the meantime should absolutely support ongoing efforts to help small businesses right now.

We shouldn’t let fixable problems get in the way of ending a uniquely Californian tax practice. Prop 13 is weird, and it’s messing us up. We can fix problems one step at a time.

Vote yes on Prop 15 to break the Prop 13 loophole for commercial property taxes.

Then take a look at Appendix D to see Prop 13 impact on residential taxes…

Follow the money

Source: Voter’s Edge, accessed 2020-10-23.

$63M raised for YES, $61M raised for NO.

Primary YES donors:

- Teachers interest groups $20M

- Chan Zuckerbeg Initiative $14.5M

- SEIU CA & Locals: $14M

Primary NO donors:

- Business interest groups $35.2M

- U-Haul + Public Storage $1.7M

Sample impact analysis

Let’s consider a hair salon. Basic facts:

- footprint: 1,500 sqft

[2] - workers: 8 stylists

[2] - leased in a 10,000 sqft commercial building

Let’s figure taxes for that building:

- 2020 building value: $4,170,000 $417/sqft (see appendix B)

- 1990 building value: $1,490,000 $149/sqft (see appendix C)

- today’s taxable rate at Prop 13 max 2%: $2,700,000 assessed value

In Oakland, today’s total property tax rate is 1.3688%. [3]

- 2020 Prop 13 taxes: $2.7M * 1.3688% ≈ $37,000

- With Prop 15: $4.17M * 1.3688% ≈ $57,000

So the Prop 15 impact is $20k. The business, occupying 1,500 sqft out of 10,000 would get 15% of the tax:

- Pass-through property taxes: $3,000 a year ($250/month)

Assuming the tax is passed to each stylist, that’s $31.25 dollars a month. That’s not huge, but it could also be several hours of work per stylist to make up for the difference. That’s a stretch, considering small businesses aren’t getting bailed out.

But what about the equipment write-off?

Let’s say the salon has ~$15,000 in equipment [4].

- $15k * 1.3688% ≈ $205.32

In Conclusion this hair salon might see a property tax increase of $3,000 a year, from the property’s assessed value. It might see a property tax decrease of $205 a year, from the business equipment write-off.

Net Effect: about $2,800 a year or $233 a month.

$233 isn’t the end of the world for a business in normal times, but these aren’t normal times. We should support ongoing efforts by the Legislature to assist small businesses.

Appendices

Appendix A: References

-

[1]National Federation of Independent Businesses, Testimony to the San Diego Board of Equalization, September 19 2019 -

[2]Kendra Aarhus, Why, Exactly, a Haircut Costs So Much -

[3]2020-10 Oakland property tax rate, Alameda County Auditor-Controller Agency, 2019-2020 Tax Rates pulled 2020-10-11 -

[4]The Salon Business by John Hallberg, How much does it cost to open a salon?

Appendix B: Determining $417/sqft in 2020-10

I surveyed “Loopnet” for commercial real estate for sale, on 2020-10-11. I recorded the first two pages of data. The average price per sqft is $417.

If commercial real estate is anything like residential real estate, the asking price is below the actual sale. Therefore, $417 might be an underestimate.

Appendix C: Determining $149/sqft in 1990

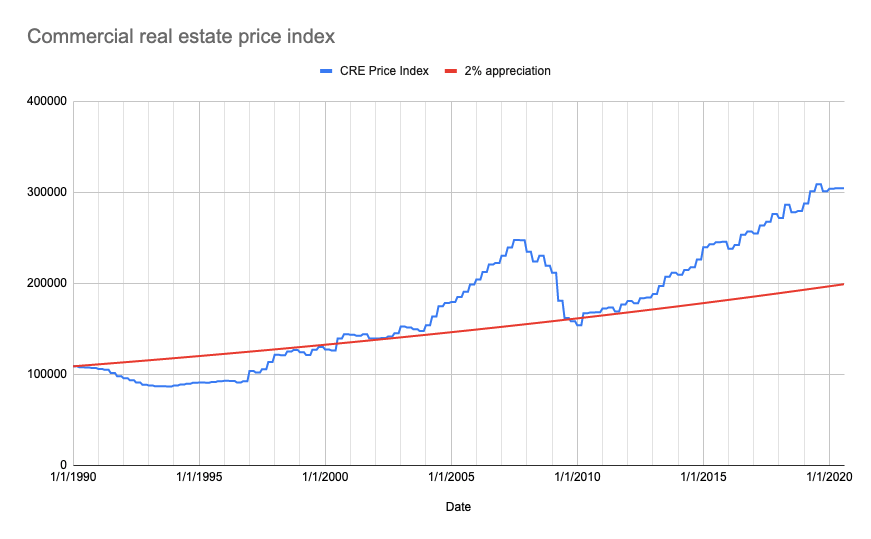

According to the US Federal Reserve Bank of St Louis, the nationwide commercial real estate price index appreciated by 2.8x between 1990 and 2020. For comparison’s sake I have added a steady 2% appreciation of the initial value, which over 30 years amounts to 1.8x appreciation.

Source: Federal Reserve Bank St Louis

It’s not quite right to assume California commercial real estate follows national trends 1-to-1, however it should be within the general ballpark considering California is a major driver in the US economy.

Taking $417/sqft and removing the 2.8 appreciation yields $149/sqft.

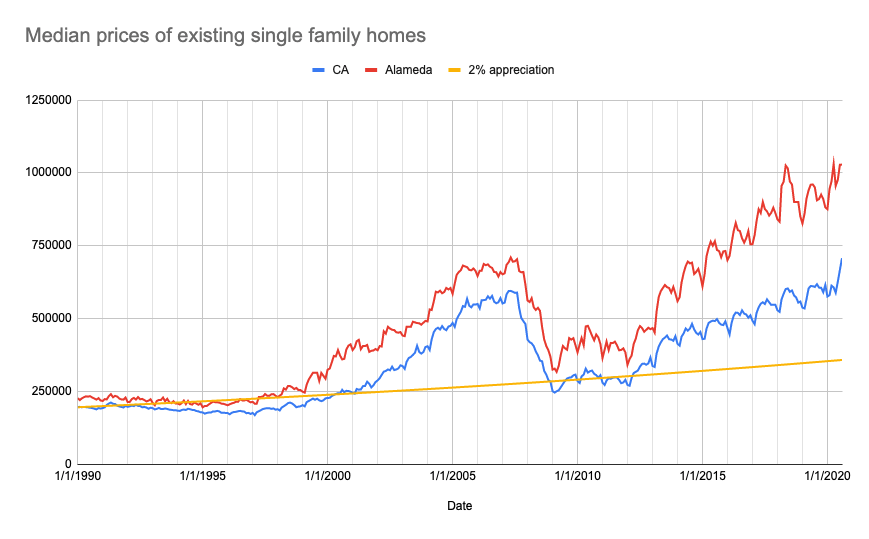

Appendix D: Residential prices: actual vs. Prop 13 2%

For your reference, here is the median price of existing single-family homes in California, according to the California Association of Realtors accessed 2020-10-10. I’ve added the 2% Prop 13 cap for reference. Here’s my spreadsheet.

This graph gives us a sense of how much single family homes are “underpaying” due to Prop 13.